Introduction

Navigating personal tax planning can seem daunting, but with the right strategies, it becomes a manageable task. Personal tax planning is essential for optimizing your financial health and ensuring compliance with tax regulations. Understanding the basics can help you make informed decisions that can lead to significant savings.

Understanding Personal Tax Planning

Personal tax planning involves organizing your financial affairs to minimize tax liabilities. It requires a comprehensive understanding of current tax laws and how they apply to your situation. This process encompasses various aspects such as income, deductions, credits, and investments. By planning ahead, you can take advantage of legal tax benefits and avoid last-minute stress during tax season.

Key Tips for Effective Tax Planning

1. Know Your Tax Bracket: Understanding your tax bracket is crucial for personal tax planning. It helps you anticipate your tax liability and adjust your financial activities accordingly. This knowledge can guide your decisions on income generation and deductions.

2. Maximize Deductions and Credits: Make sure you are aware of all the deductions and credits for which you qualify. Common deductions include mortgage interest, medical expenses, and charitable contributions. Tax credits such as the Earned Income Tax Credit can also significantly lower your tax bill.

3. Consider Retirement Contributions: Contributions to retirement accounts like 401(k)s or IRAs can reduce taxable income, providing immediate tax benefits while also securing your financial future. Personal tax planning should include strategies for maximizing these contributions.

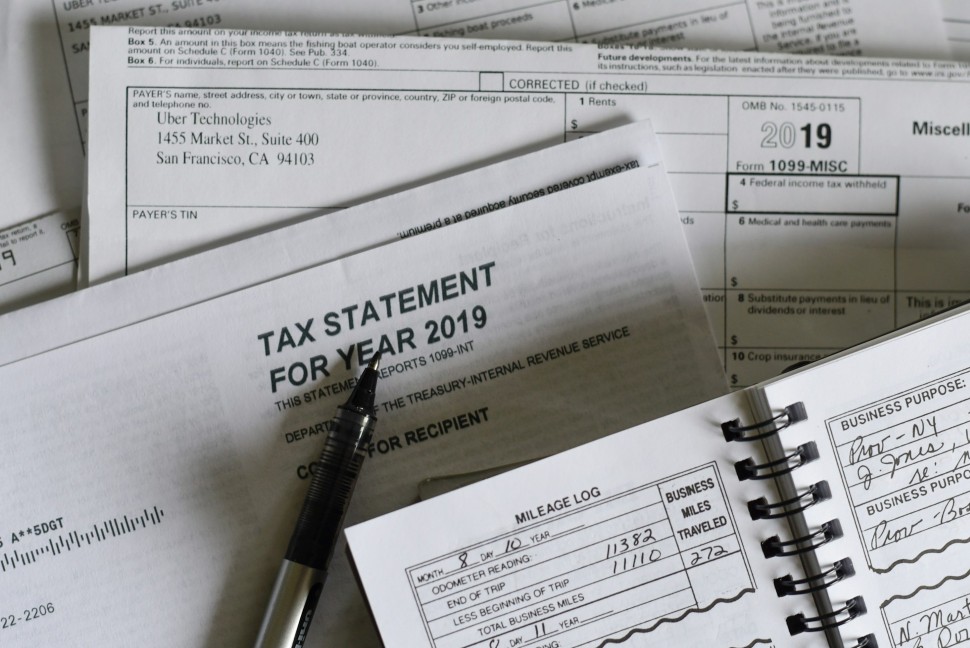

4. Keep Accurate Records: Maintaining organized records of income, expenses, and receipts is essential for effective personal tax planning. Accurate documentation makes it easier to claim deductions and credits and provides a safety net in case of audits.

5. Plan for Major Life Changes: Events such as marriage, having children, or buying a home can significantly impact your taxes. Personal tax planning should include preparations for these changes, ensuring you understand their tax implications.

Conclusion

Personal tax planning is a vital part of financial management that can lead to substantial savings and peace of mind. By understanding your tax obligations and making informed decisions, you can optimize your tax situation. Whether you’re planning for retirement, managing deductions, or preparing for life changes, a proactive approach to personal tax planning can have lasting benefits. Remember, consulting with a tax professional can provide personalized advice to enhance your tax strategy and ensure compliance with all regulations. With careful planning and attention to detail, you can navigate personal tax planning effectively and achieve your financial goals.

——————-

Visit us for more details:

Cloud Accounting & Tax Services Inc. | CLaTAX

https://www.claccounting-tax.ca/

+1 (855) 915-2931,

Glenlyon Corporate Centre, 4300 N Fraser Wy #163, Burnaby, BC V5J 5J8

Brand Profile: Cloud Accounting & Tax Services Inc. | CLaTAX

Mission Statement

We aim to protect our clients’ financial interests with integrity, providing essential services for a secure financial future. We treat our employees and clients with respect and professionalism.

Vision

To be Canada’s leading provider of innovative accounting and tax solutions, leveraging technology for accessible, high-quality financial services.

Values

Integrity: Ethical and transparent operations.

Excellence: Constantly improving to meet clients’ needs.

Client-Centric: Tailored services for unique goals.

Innovation: Utilizing the latest technology.

Respect: Professional treatment for all.

Services

For Individuals and Families

Personal Income Tax Preparation

Penalty and Interest Relief Requests

Income Tax Reviews

Pension Assistance

Financial Management Solutions

For Business Owners

Bookkeeping Services

Tax Planning and Consultancy

Payroll Solutions

Penalty and Interest Relief

Financial Management Solutions

For Corporations